-

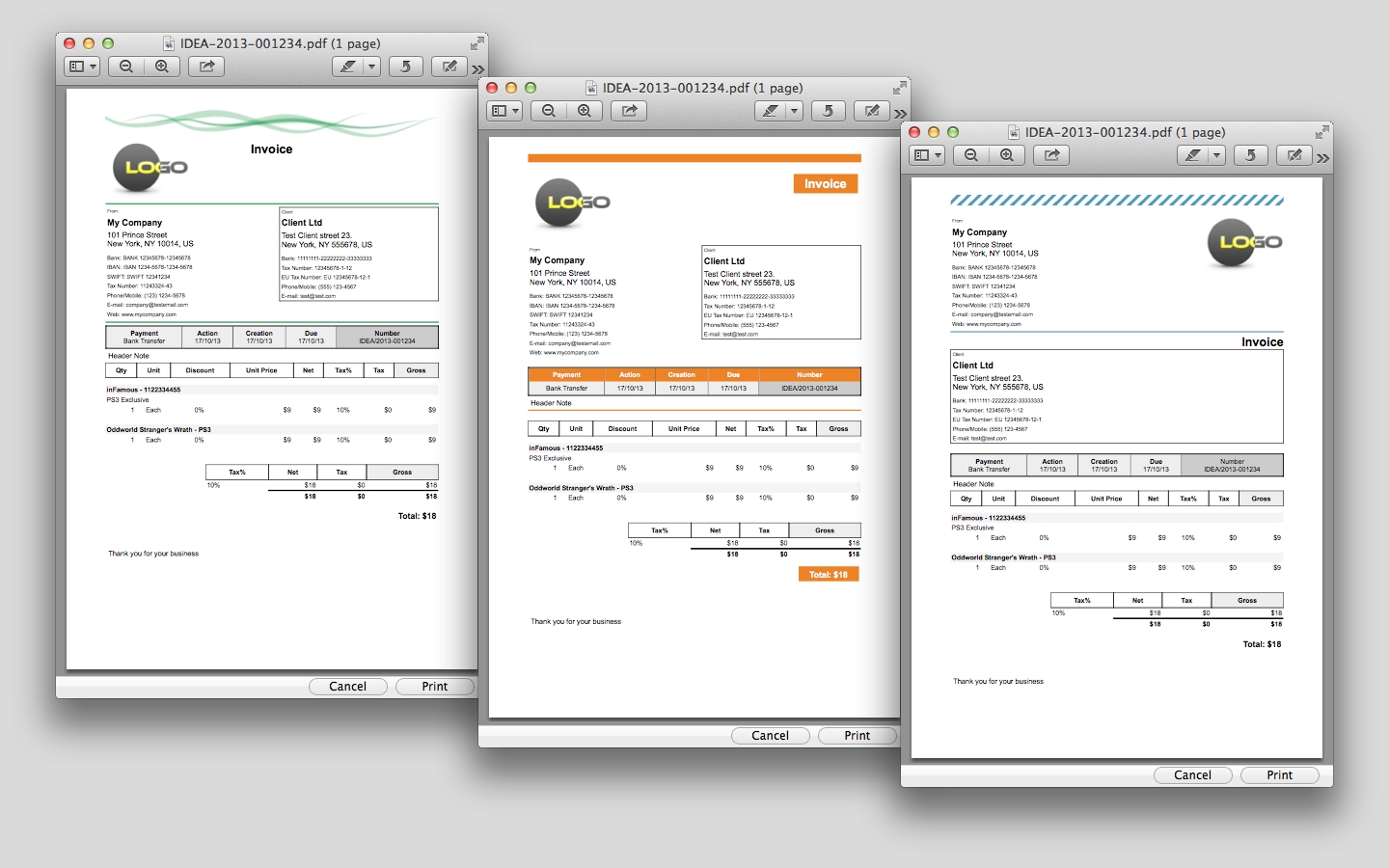

Invoice Template For Simple Invoice Software For Mac카테고리 없음 2020. 2. 10. 04:22

While for now Invoice Manager for Excel (namely Uniform Invoice Software) is a Windows desktop invoicing software program based on Excel, our free blank invoicing templates and billing forms use pure-Excel features, which enables you to adapt our invoice formats on your Mac system.

With its comprehensive interface and functions, Express Invoice Free for Mac would be an asset to any small business owner. Its ability to create reports in addition to invoices gives it an extra level of help to users.

Express Invoice Free for Mac installs as part of a set of programs for businesses that the user can also add by checking boxes during setup. Once the main program begins, it walks the user through an initial setup where the user's business information, including name, address, and phone number, can be added.

This allows the program to automatically fill in this information in all created invoices, speeding up the process. The main menu includes good graphics labeling all the major functions well. The top row includes several buttons for creating invoices, reports, and accessing the preferences, among others. A sidebar on the left also contains most other features, but allows them to be hidden or revealed by clicking a triangle situated next to each. The main screen initially contains shortcuts that are nearly identical to those along the top row. Clicking them brings up a separate menu, such as the one for creating invoices. This screen allows the user to type in details on the client, item purchased, and salesperson information.

Similar secondary screens for the payment allow information entry to attribute payments received to existing invoices and clients. The reports area can return outstanding payments sorted by categories, including client, date, and salesperson.

Express Invoice Free for Mac contains all of the functions necessary for creating and tracking client accounts, payments, and invoices in a well-designed and organized interface, making it a good solution for small business owners. Express Invoice Free for Mac OS X business invoice software. Billing software made easy.

Includes remote web console access so multiple users can generate invoices, manage clients and generate billing reports. Express Invoice for Mac allows you to create recurring invoice templates for ongoing services and link to credit card gateways to easily process payments for goods and services. Express Invoice for Mac also includes a number of standard reports such as unpaid accounts, payments, sales person, accounting reports and more.

You can then print, email or fax your invoices to your clients directly. Full Specifications What's new in version 5.05 The latest version is a new release that may include unspecified updates, enhancements and bug fixes. General Publisher Publisher web site Release Date March 27, 2017 Date Added October 11, 2018 Version 5.05 Category Category Subcategory Operating Systems Operating Systems Mac Additional Requirements. macOS Mojave. macOS High Sierra. macOS Sierra. OS X El Capitan.

OS X Yosemite. OS X Mavericks. OS X Mountain Lion. OS X Lion.

Invoice Template Download Mac

OS X Snow Leopard Download Information File Size 2.64MB File Name expressinvoicerefsetupcnt.zip Popularity Total Downloads 16,685 Downloads Last Week 7 Pricing License Model Free Limitations Not available Price Free.

Simple & basic invoice templates Here's the bottom line: If you want to get paid for any services you provide, you're going to need to supply your customers with an invoice. Consumers expect documentation of their payment. If you're looking for an invoicing solution that takes away all of the complexity of our more specific templates, our free simple invoice template is for you. We've created a bare-bones, basic invoice template to get you paid without the hassle of learning how to use the features you don’t need. Download a simple invoice template.

The best part about a simple invoice is the freedom it gives you to change and adapt, even on the fly. Having a blank slate to document your services can be helpful. The standard simple invoice format includes a place for:. The name of your company (or your name). The name of your customer. The date. Invoice number and/or job and customers codes (if applicable).

A description of what the customer is paying for. Quantity (if applicable) of what the customer is paying for. How much they are being charged per hour or per unit (if applicable). Subtotal. Line items for any taxes or discounts (if applicable).

Total amount being charged to the client From there, it really depends on your specific industry. If you’re using this basic invoice form for a bill of sale, you may want to itemize the products sold—this helps you keep track of inventory and is something the customer will certainly want to see on an invoice. If you’re providing a service, you may want to leave some space for notes and future recommendations regarding that service. When it comes to sending invoices to clients, it’s important to take into consideration your customer-base, as well as the image you would like to project. Generally speaking, larger companies will send an invoice at the end of the customer engagement while smaller companies or individuals practice the “due upon receipt” policy, having the invoice paid as soon as the transaction is complete.

Invoicing at the end of the engagement has a certain professionalism to it, and gives off the sense that the business is established. For larger companies, cash flow may be calculated by monthly goals, so getting paid immediately or two weeks later is relatively inconsequential.

Small businesses or individuals often adopt this policy to project that established professionalism to their customers. Having your invoice due upon receipt is a perfectly acceptable practice, as well. Most small companies or individuals would do well to use their size as an asset, as they are able to provide more attentive service to their customers than the big companies. That being said, most customers understand that immediate cash flow is essential to keeping smaller operations running smoothly. Proper invoicing practice is integral to success. Here are some pro tips from Sage on the best invoicing practices to please your customers and ensure prompt payment.

Set definite payment deadlines – if your invoices aren’t to be paid immediately, you should spell out a clear due date for your customers. Don’t worry about coming off as pushy—you are the professional and your customers understand you need to be paid.

Be clear – a simple, easy-to-understand basic invoice layout is important so your customers know exactly what they’re paying for and under what terms. Being clear is also beneficial to you, as it makes reviewing and making record your invoices easier and quicker. Keep the client in mind – using a simple invoice template allows you to easily customize according to the client being billed.

Subtle specificity can go a long way in showing your attention to detail and care for the customer. Itemizing goods or services, offering discounts (and listing them on the invoice itself), or even writing a personalized note of thanks to your client in a blank spot on an invoice—these are the things people remember after the transaction. Try out these tips and we’re sure you’ll be pleasantly surprised. When you’re ready to take your invoicing to the next level, automating and streamlining the whole process, check out tools. Using a basic invoice template allows for a ton of customization.

Check out these tips from business owners who found success tailoring their invoice layout and process to suit their needs. Offer discounts for early payment – everyone loves a discount, so don’t underestimate their effectiveness in getting your customers to pay. Even a small discount off of the bill can be a great incentive for your customer to settle up. Not to mention, paying less than expected is always a nice surprise for the client. Accept all forms of payment – the easier you make it to pay you, the easier you’ll get paid—it’s that simple. Your customers want to pay you the way that’s most convenient for them. Accepting credit/debit cards and checks is an essential.

Many modern businesses are finding success accepting payments through Paypal, Venmo, and other online money transferring services. Be polite but firm – it’s a fine line to walk between being too cold or too chummy with your customer. A good compromise is to keep the coldness in writing, where it counts. At the end of the day, you need to get paid for what you provide—being firm in payment terms without excluding the niceties of “please” and “thank you” is your best bet for getting paid without putting the customer off. Take your invoicing to the next level with Sage Business Cloud Accounting Save time and save trees by switching to online invoicing with Sage Business Cloud Accounting. Upgrading is easy and can make the all the difference when positioning your business in the modern world. An online presence is essential for businesses today—and adapting to your customers’ preferred methods of payment can set you apart from your competitors.

Sage Business Cloud online invoicing digitizes and automates the billing process, making sure you get paid and your customers stay happy. Start your free trial today!